Dodla Dairy Ltd IPO opens tomorrow: should you subscribe?

After a brief pause, a handful of IPOs are expected to hit the Indian stock market this monsoon. On Mon this week, Shyam Metalics IPO and a few others opened for subscription, and on Wed, KIMS Hospitals and Dodla Dairy IPOs are prepping to open for retail investors. Here, let us evaluate Dodla Dairy IPO.

The article covers:

- About Dodla Dairy Limited

- Operations of the company Ltd

- Details of Dodla Dairy IPO

- Book running lead managers and registrar to the issue

- Reservation of IPO for various categories of investors

- Utilisation of the IPO proceeds

- Promoters of Dodla Dairy

- Peers of Dodla Dairy Ltd

- Financials of Dodla Dairy Ltd

- Strengths of the company

- Risks of Dodla Dairy Ltd

- Prospects of the company

Table of Contents

- About Dodla Dairy Limited

- Operations of Dodla Dairy Ltd

- Details of Dodla Dairy IPO

- Book running lead managers and registrar

- Reservation of IPO for various categories of investors

- Utilisation of the IPO proceeds

- Promoters of Dodla Dairy

- Peers of Dodla Dairy Ltd

- Financials of Dodla Dairy Ltd

- Strengths of Dodla Dairy

- Risks of Dodla Dairy Ltd

- Prospects of Dodla Dairy

About Dodla Dairy Limited

Operations of Dodla Dairy Ltd

Dodla Dairy has 13 processing plants and 86 milk chilling centres in India. The combined capacity of its 13 processing and packaging plants is 17 lakh litres of raw milk on a daily basis. Additionally, the dairy company also has 2 skimmed milk powder plants with an installed capacity of 25,000 kgs per day.

Dodla Dairy processing plants process raw materials into packaged milk and also manufacture value-added dairy-based products. It then distributes and sells its consumer-friendly packaged products through a robust distribution network of 40 sales offices, 3,336 distribution agents, 449 product distributors, and 863 milk distributors across 11 states. The company has 371 ‘Dodla Retail Parlors’ through which it sells products to retail consumers.

Details of Dodla Dairy IPO

- The Rs 520-cr worth IPO opens on 16th Jun 2021 and closes on 18th Jun 2021

- It comprises a fresh issue of Rs 50 cr and an offer for sale of up to 1.09 shares or ~Rs 470 cr

- The face value of each share is Rs 10 while the IPO is priced in the range of Rs 421 to Rs 428 apiece

- The IPO can be subscribed in a lot of 35 shares; you can apply for up to 13 lots

- Dodla Dairy will be listed on both BSE and NSE and the likely date of listing is 28th Jun 2021

Book running lead managers and registrar

The dairy company is promoted by Dodla Sesha Reddy, Dodla Sunil Reddy, Dodla Deepa Reddy, and Dodla Family Trust. The promoters and investors selling their shares include Dodla Sunil Reddy, Dodla Deepa Reddy, and TPG Dodla Dairy Holdings.

Axis Capital and ICICI Securities are the book running lead managers of the IPO. KFintech Pvt Ltd is the registrar to the issue.

Reservation of IPO for various categories of investors

- 50% of the issue is reserved for qualified institutional buyers

- 5% is reserved for non-institutional investors

- 35% of the IPO is reserved for retail investors

Utilisation of the IPO proceeds

The objective of the IPO is not to expand its operations but to strengthen Dodla Dairy’s footprint in South India. Here’s how the company looks to use the funds raised via the IPO:

- Rs 32.26 cr would be used for full/partial repayment or prepayment of credit availed from ICICI Bank, HDFC Bank, and the Hongkong and Shanghai Banking Corporation

- Around Rs 7 cr would be used to fund incremental capital expenditure

- The rest would be used for general corporate purposes including research and development, hiring new talent, and digitisation

Promoters of Dodla Dairy

The dairy company is promoted by Dodla Sesha Reddy, Dodla Sunil Reddy, Dodla Deepa Reddy, and Dodla Family Trust. The promoters and investors selling their shares include Dodla Sunil Reddy, Dodla Deepa Reddy, and TPG Dodla Dairy Holdings.

Below is a chart depicting the change in the pre- and post-issue promoter share holding:https://live.amcharts.com/zNTM5/embed/

Peers of Dodla Dairy Ltd

Dodla Dairy Ltd competes with the likes of Tirumala Milk Products, Creamline Dairy Products, Parag Milk Foods, Heritage Foods, and Hatsun Agro Products of which the last 3 are listed. As of 31st Mar 2020, Hatsun Agro Products clocked a net profit of Rs 112.27 cr, Heritage Foods of Rs 169.4 cr, and Parag Milk Foods of Rs 93.69 cr. In comparison, Dodla Dairy declared a net profit of Rs 49.87 cr.

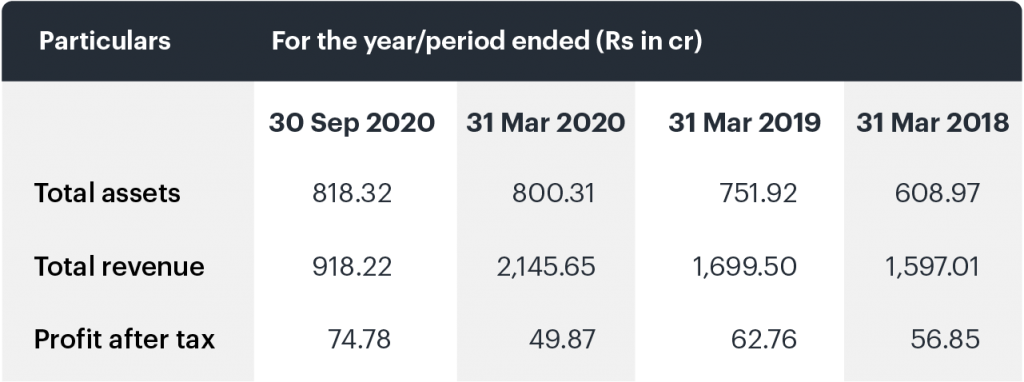

Financials of Dodla Dairy Ltd

- Over the FY 2018 to FY 2020, the company’s revenue from operations grew at a 15.98% CAGR and EBITDA at an 11.81%

- Due to the pandemic-caused disruptions, Dodla Dairy’s volumes fell by 20% and sales descended by 12% in the 4 quarters to Dec 2020

- During FY 2020, its revenue from operations stood at Rs 21,39.37 cr, EBITDA at Rs 140.9 cr, and the profit after tax at Rs 49.87 cr

- For FY 2020, the company’s return on equity (ROE) and return on capital employed (ROCE) stood at 11.50% and 17.01%, respectively

- As of 31st Mar 2021, the company’s total outstanding debt stood at Rs 87.3 cr comprising long-term borrowings, working capital facilities, and NCDs

- For the 9-mth ended Dec 2020, its revenue from operations, EBITDA, and profit after tax were Rs 1,413.51 cr, Rs 206.5 cr, and Rs 116.38 cr, respectively

- Over the past 3 yrs, Dodla Dairy has commissioned a new processing plant at Rajahmundry, acquired the cattle feed and mixing plant by Orgafeed Pvt Ltd at Kadapa, acquired the processing plants at Batlagundu and Vedasandur from KC Dairy Products Pvt Ltd, and established new VLCCs, whereby it incurred a cumulative capital expenditure of Rs 264.4 cr

Here’s a table displaying certain financial items for 4 different periods.

Strengths of Dodla Dairy

- Dodla Dairy has a large product portfolio of milk variants and value-added dairy products

- It is not only a leading dairy player in South India but also has an international presence in a few parts of Africa

- The company has continued to be profitable for the last 3 financial years

Risks of Dodla Dairy Ltd

- A major chunk of the company’s revenue comes from its milk and dairy products, whose margins are limited. Any adverse impact on the sale of these products may hurt its business and financials

- The industry is dominated by unorganised players that pose added challenges to its business

- As per the company, the pandemic has affected and may continue to impact its business, operations, and financial situation in several ways including hurting its sales volume and revenues, which can be seen from 31st Dec 2019 to 31st Dec 2020. The company’s sale of products in metro cities of Bengaluru and Chennai have declined due to the migration of residents to their home towns due to the pandemic. Besides, the sales to commercial players were also impacted

Prospects of Dodla Dairy

Although the coronavirus pandemic has affected the company, it is optimistic about its performance in the post-pandemic era, when the company expects to grow at the rate of 15-20%.

That’s all folks. Although you have all the essential information needed to make an investment decision, we encourage you to do your homework about the company before subscribing to the IPO.