All About Rakesh Jhunjhunwala Backed Metro Brands IPO

Metro Brands Ltd., backed by experienced investor Rakesh Jhunjhunwala, will launch its initial public offering on Friday, allowing its promoters and promoter group shareholders a partial exit. After Star Health and Allied Insurance Co., this is the second initial public offering by a Jhunjhunwala-backed business this month. Let us read all we need to know about Metro Brands IPO to properly assess this opportunity.

Table of Contents

- About Metro Brands

- Promoter and investors exiting their shares

- About Metro Brands IPO

- Book running lead managers and registrar of the Metro Brands IPO

- Reservation of Metro Brands IPO for various investor categories

- Objects of the Metro Brands IPO

- Financials of Metro Brands

- Peer comparison

- Strengths of the company

- Risks of the Metro Brands

About Metro Brands

Metro Brands is a footwear retailer in India that focuses on the economy, mid, and luxury sectors of the footwear industry. It inaugurated its first Metro store in Mumbai in 1955 and has since expanded into a one-stop shop for all footwear requirements, retailing a broad choice of branded items for the entire family. As of 30 September 2021, this corporation operated 598 stores in 136 cities throughout 30 Indian states and union territories.

With shifting customer attitudes regarding footwear, the Indian footwear sector has seen increased activity in recent years. As of FY 2020, the footwear category accounts for roughly 1.5% of the whole retail business and is valued at Rs. 1 tn. The category is predicted to develop in the next few years, reaching an estimated Rs. 1.4 tn. by FY 2025, at a CAGR of roughly 21% between FY 2021 and 2025. (Source: CRISIL Report).

The firm focuses on the footwear market’s mid and premium segments, which have a stronger presence than organised competitors and are growing in the total footwear industry. Metro, Mochi, Walkway, Da Vinchi, and J. Fontini are some of the company’s well-known brands, as are some third-party brands such as Crocs, Skechers, Clarks, Florsheim, and Fitflop.

Metro Brands stores also sell accessories such as belts, backpacks, socks, masks, and wallets. M.V. Shoe Care Private Limited, the company’s joint venture, also sells footcare and shoe-care items at its stores. To manage its stores, the firm employs the “company-owned and company-operated” (COCO) retailing model, with their own Multi Brand Outlets (MBOs) and Exclusive Brand Outlets (EBOs).

Promoter and investors exiting their shares

- The company’s promoters are Rafique A. Malik, Farah Malik Bhanji, Alisha Rafique Malik, Rafique Malik Family Trust, and Aziza Malik Family Trust.

- The promoters will sell 1.30 cr. equity shares.

- The promoter group will sell 84.2 lakh equity shares.

- Other shareholders will sell 8,100 equity shares.

About Metro Brands IPO

- This is the maiden IPO consisting of a fresh issue of shares worth Rs. 295 cr. an offer for sale of shares worth Rs. 1,073 cr. via the book building process.

- The issue size is Rs 1,367.51 cr. at the top of the price range.

- The opening date for this IPO is 10 December 2021 and the closing date is 14 December 2021.

- Metro Brands IPO is likely to be listed on the BSE and NSE.

- The face value of each share is Rs. 5.

- The set price band of this IPO is Rs. 485 – Rs. 500.

- The allocation is expected to be finalised by 17 December, and refunds will be initiated by 20 December. Meanwhile, credit of shares in the Demat account is expected by 21 December.

- One lot consists of 30 shares and is worth Rs. 15,000 at the upper range of the pricing band.

Book running lead managers and registrar of the Metro Brands IPO

The joint global coordinators and lead managers of the Metro Brands IPO are Axis Capital, Ambit, DAM Capital Advisors, Equirus Capital, ICICI Securities and Motilal Oswal Investment Advisors.

The issue’s registrar is Link Intime India Pvt. Ltd.

Reservation of Metro Brands IPO for various investor categories

- 35% is the maximum subscription amount reserved for retail investors.

- 15% is reserved for the Non Institutional Individuals (NII).

- 50% is reserved for the Qualified institutional buyers (QIBs), wherein 60% is for anchor investors, 1/3rd of which shall be reserved for domestic mutual funds only.

Objects of the Metro Brands IPO

- Rs. 225.37 cr. will be used for opening new stores of the Company, under the “Metro”, “Mochi”, “Walkway” and “Crocs” brands.

- General corporate purposes.

Financials of Metro Brands

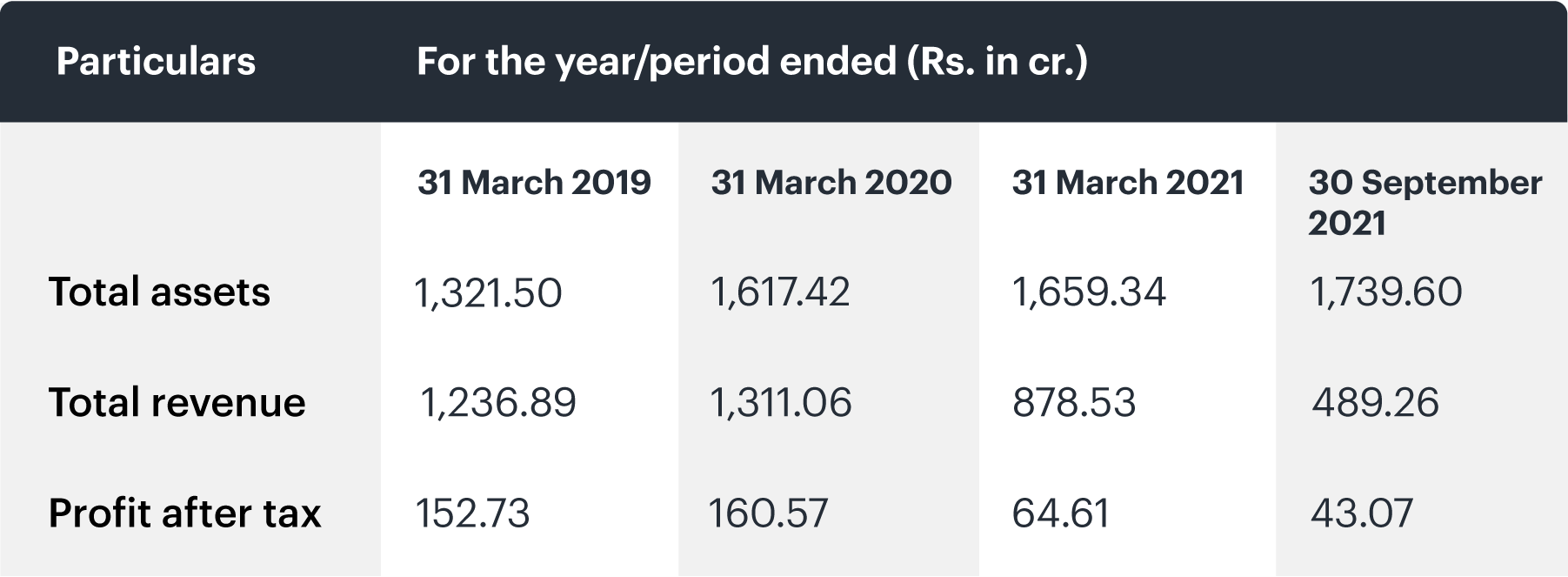

- As of 30 September 2021, it has posted earnings per share (EPS) of Rs. 1.62.

- As of 30 September 2021, the net asset value (NAV) stood at Rs. 31.64.

- As of 30 September 2021, it has posted a return on net worth (RoNW) of 4.94%.

- As of 30 September 2021, it reported an EBITDA of Rs. 111.42 cr.

Following are the financials for 2019, 2020, and 2021

Peer comparison

According to the offer paperwork, the company’s listed peers include Bata India and Relaxo. They are not, however, genuinely comparable on an apple-to-apple basis.

Strengths of the company

- It is one of the major footwear dealers in India.

- Has a diverse choice of brands and products available.

- It has a lean operational strategy and a low-asset business.

- Has a good presence in a variety of media and channels.

- It is the first choice for other national and international third-party brands.

- Has an experienced management team and a strong promotional background.

- It has a good track record of profitability and growth.

Risks of the Metro Brands

Investments in equities and equity-related securities are risky. Before making an investment choice in an IPO, you should carefully consider the risk factors.

- The present and ongoing COVID-19 epidemic have had a substantial impact on its company and operations. The future impact of the pandemic on operations, including its effect on customers’ ability or desire to visit stores, is uncertain and may be significant and continue to have an adverse effect on its business prospects, strategies, business operations, future financial performance, and share price.

- The capacity to predict and forecast client demand and trends is critical to the company’s success. Any forecasting inaccuracy might result in either surplus stock, which it may not be able to sell in a timely or at all, or understocking, which could impair its capacity to satisfy consumer demand.

- Inability to quickly detect and adapt to changing client preferences or emerging trends may reduce customer demand for its products, which may have a negative impact on its business, profitability, and results of operations.

- The premises of all its stores and warehouses are leased. If it fails to renew these leases on competitive terms or if it is unable to manage the lease rental costs, its results of operations would be materially and adversely affected.

- It is dependent on third-parties for the manufacturing of all the products it sells. Any disruptions at such third-party manufacturing facilities or failure of such third-parties to adhere to the relevant quality standards may have a negative effect on its reputation, business and financial condition.

Rakesh Jhunjhunwala is the third-largest stakeholder and is not divesting his stake from this company and this company has a good brand image. If you are interested in this investment opportunity, make sure to conduct thorough research before subscribing to Metro Brands IPO. To ensure a seamless experience while subscribing to Metro Brands IPO, read the article on how to subscribe to an IPO.