Introducing smallcases on Tickertape! Research Backed Portfolios Now at Your Fingertips.

We are thrilled to introduce you to a game-changing investment product on the Tickertape platform – smallcase! With smallcase, you can now invest in ready-made portfolios of stocks/ ETFs/REITs curated by industry experts.

But before we take you through the journey of investing in smallcases on Tickertape, let’s quickly look at what smallcase is and why you should consider investing in it.

Table of Contents

- What is a smallcase?

- Who creates these smallcases?

- How to invest in smallcases?

- How to track smallcase performance?

What is a smallcase?

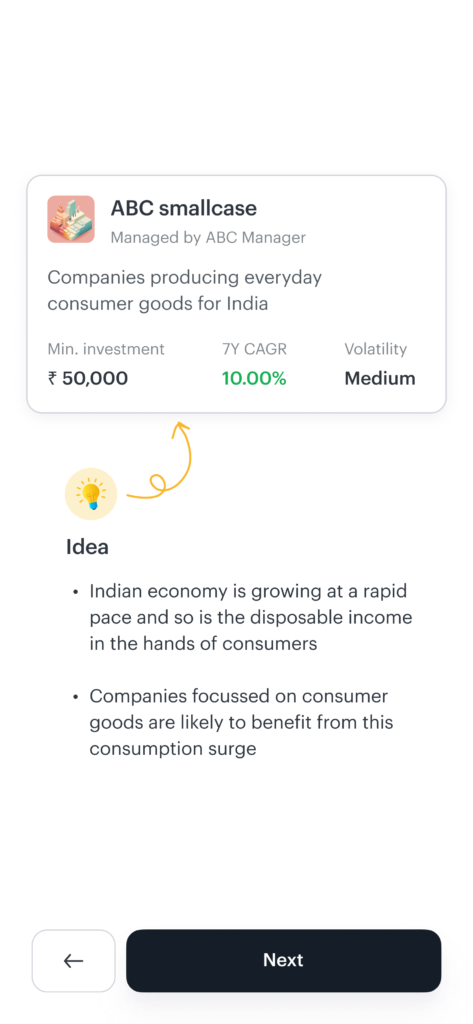

smallcase is a modern investment product that helps investors build long-term and diversified stock portfolios easily. Essentially, a smallcase is a basket of stocks/ETFs/REITs that represents an idea – an objective, theme, or strategy.

For example, there are smallcases that are available which allow you to track and invest in specific sectors, like pharma, auto, energy, IT etc. There are other smallcases that allow you to invest in themes, like that of rural India, Atmanirbhar Bharat, the Electric Vehicle ecosystem, etc. Moreover, There are various smallcases based on certain investing strategies such as momentum, dividend etc.

smallcase Managers are Investment Advisers, Research Analysts, and other similar professionals.

Who creates these smallcases?

smallcases are created and managed by SEBI-registered entities such as investment advisors, research analysts and brokers, and they are referred to as smallcase Managers. The objective and rationale of each smallcase are clearly stated in the factsheet prepared by the smallcase Manager, so that you can make an informed decision.

What are the benefits of investing in smallcases?

Let’s see some of the reasons why investors prefer smallcase as an investment option instead of direct stock investing:

- Research and analysis by top financial experts: Investing in equities requires in-depth knowledge, expertise and research know-how about the markets. smallcases are created & managed by SEBI-registered financial experts, and hence you can invest with confidence in their knowledge and also save time and effort on stock analysis.

- Convenient and time-saving investment solution: Let’s be honest; even if we do have knowledge about stock markets, not all of us have the time for rigorous stock analysis. However, it is much easier to assess whether an idea or a theme is going to do well or not. With smallcases, you don’t invest in single stocks or a random stock portfolio; you actually invest in a theme, strategy or objective that the smallcase is based on.

- Portfolio-based investing: Investing in a stock portfolio has proven to be more beneficial than investing in one or two stocks – due to something called portfolio diversification. A portfolio approach allows you to diversify across market segments and capitalisations and aims to safeguard your investment against the volatility of individual stocks.

- Complete transparency and control: With smallcase, you have complete knowledge about where your money has been invested in. The shares bought through smallcase would be credited to your broker demat account, thereby giving you full control over your investments. There are no lock-in periods, and you are free to sell your holdings at any time. You can even customise your smallcase investments or tweak them according to your needs.

How to invest in smallcases?

Step #1 – Discover and analyse

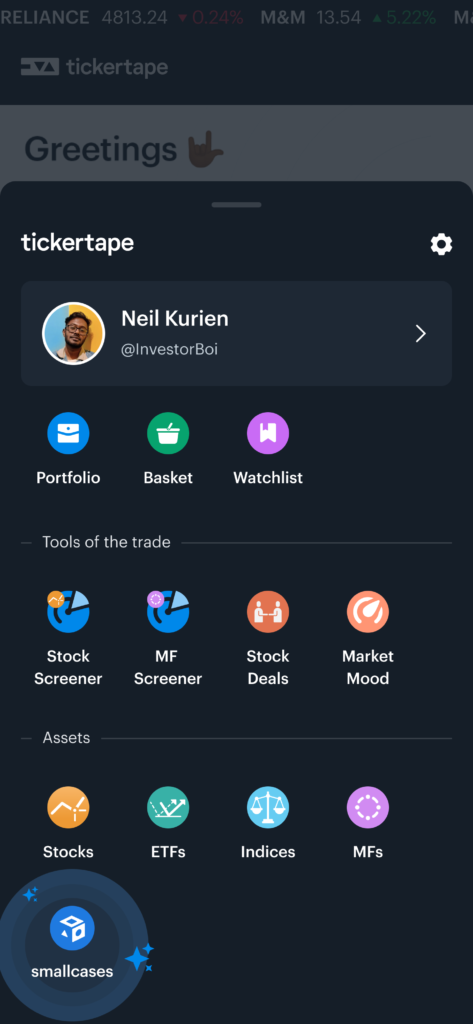

Go to the smallcase homepage from the product switcher and explore the list of smallcases by managers.

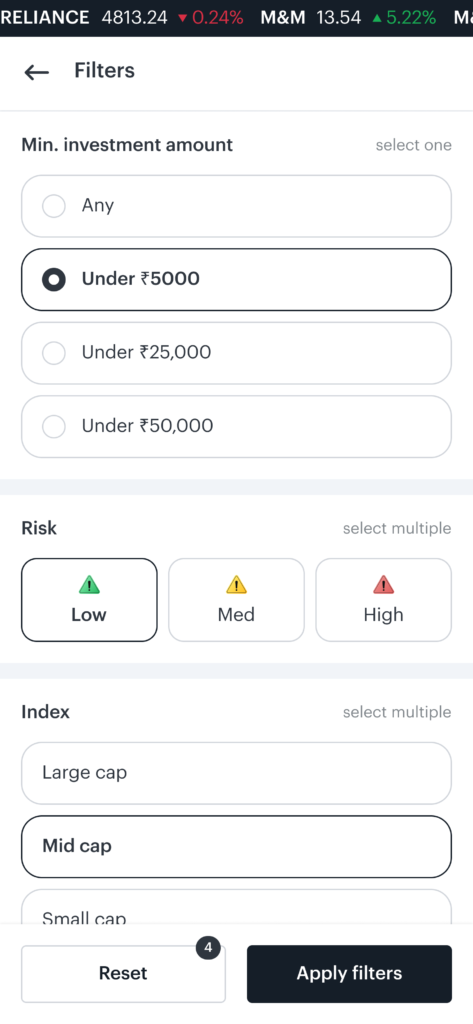

You can use different filters, such as minimum investment amount, volatility, etc., to check out smallcases that might be suitable for you.

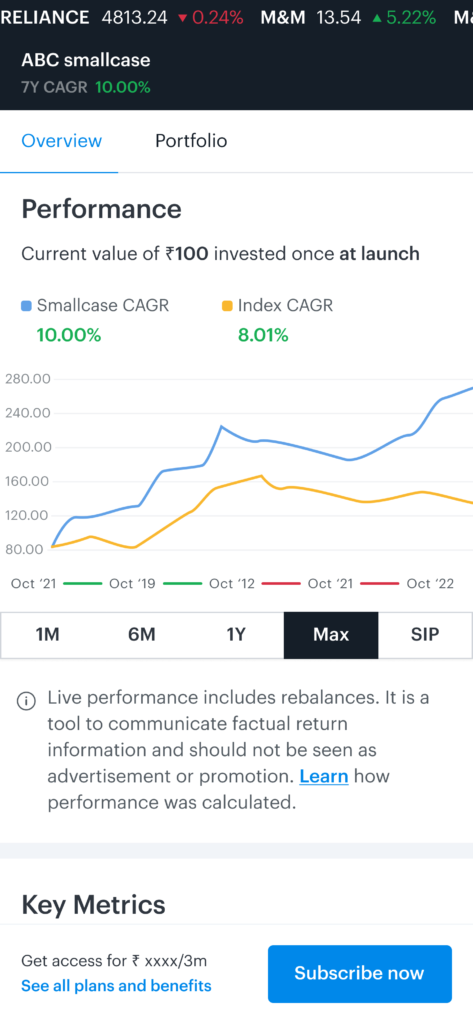

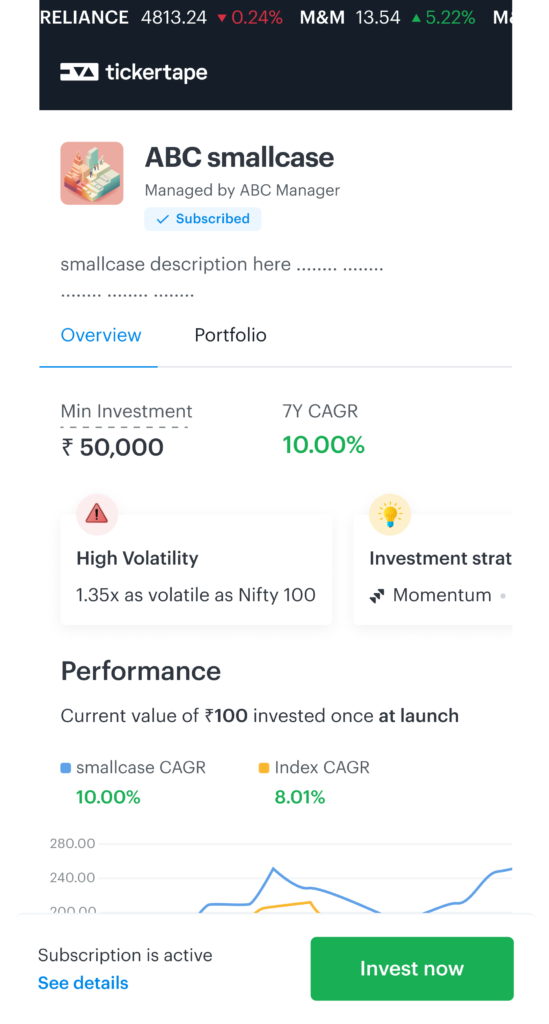

Next, you can go to the smallcase page to analyse all the important information required to make investment decisions like the track record of the smallcase and the Manager, volatility, key metrics, rationale, etc.

Step #2 – Subscribe

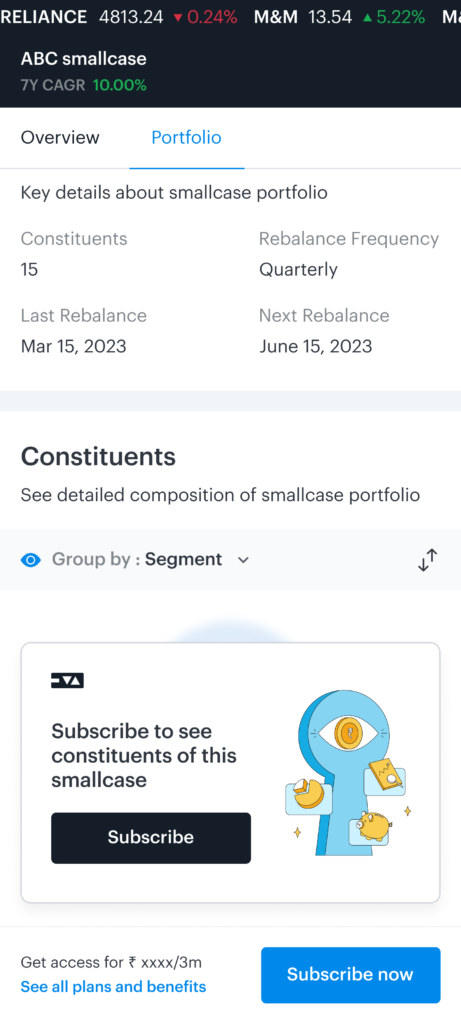

Once you have chosen your smallcases, the next step is a subscription. To access the list of stocks/ETFs (along with weights) in the smallcase and to be able to invest in the same, you are required to subscribe to the smallcase by paying a subscription fee to the smallcase manager. This fee is for the research and expertise that they bring to the table. smallcase subscription also gives you access to regular rebalance updates to the smallcase portfolio.

All you have to do is enter your contact details and PAN number, choose your state, and pick from the subscription plans offered by the manager. An option to auto-renew a subscription is also available. For a few managers, you need to assess your risk profile. This helps you understand if the smallcase fits your risk appetite. If the smallcase doesn’t fit your risk profile, you are recommended smallcases that suit your risk appetite. You can either choose to invest in a smallcase from the suggestions or continue investing in the one you picked initially.

Step #3 – Invest, manage, and sell

Once you have gotten the subscriptions to your chosen smallcases, all that remains is clicking on the “Invest Now” button. Note that transacting in smallcases would require users to log in to their trading account with their Broker. Once done, the constituents of the smallcase get credited directly into your Demat account as per the market settlement cycle – making you the legal owner of the securities.

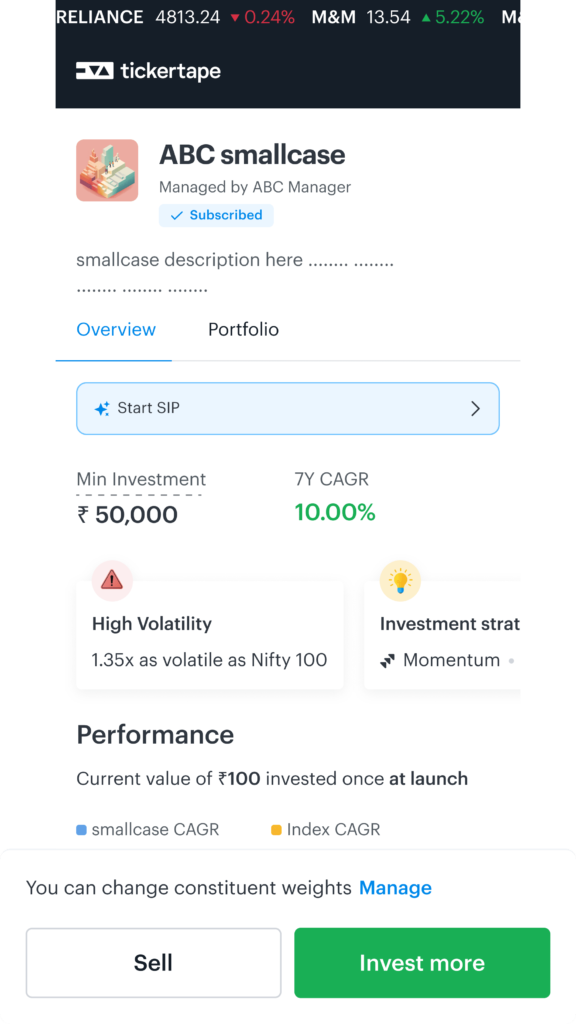

Once invested, you can “Invest More” in the same constituents and in the same proportion as recommended by the Manager, or you can “Manage” the smallcase investment by adding or removing stocks/ETFs or changing the weights of existing stocks/ETFs.

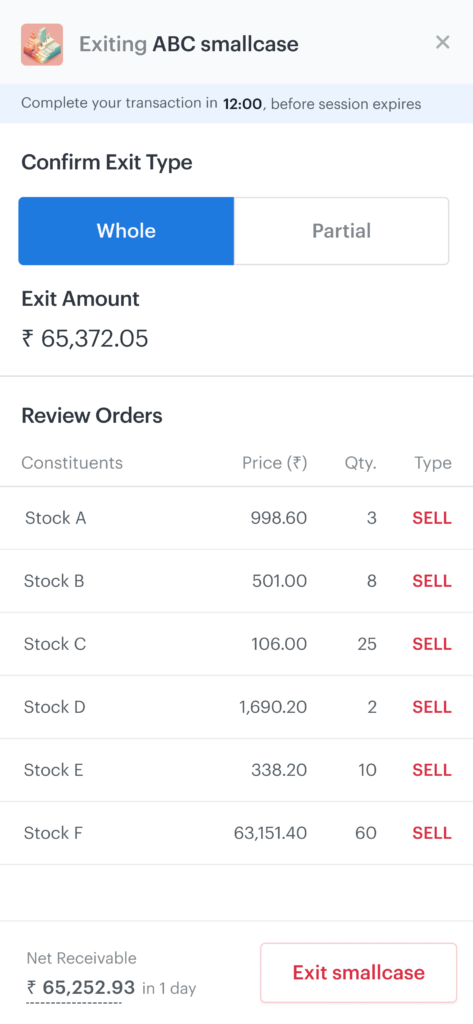

Exiting your smallcase investment is also a single-click process with the option to exit partially or completely.

Other actions

SIP

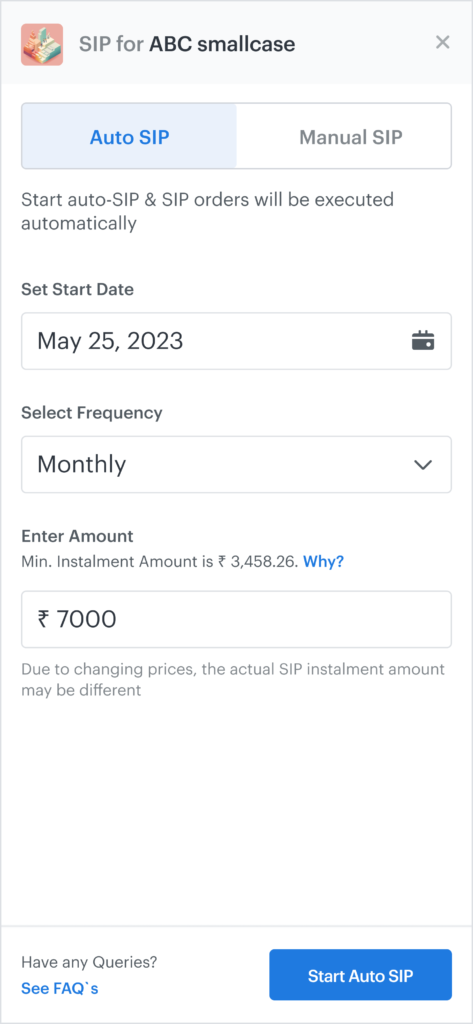

With smallcases, it is easier than ever to adopt the disciplined investing approach. You can now buy a smallcase and start a Systematic Investment Plan (SIP) for it in just 1 click! Just add the start date, amount and frequency as per your requirements, and you’re set. However, you should check whether your smallcase broker provides for SIP orders. You can simply view your broker FAQ details for further information.

There are two types of SIP options available: Manual SIP and Auto SIP. With Manual SIP, you will be notified about the SIP due date via email, and you can approve the SIP by visiting the smallcase page on Tickertape. With Auto SIP, an investor must create a mandate with their bank authorising it to transfer the minimum SIP amount to the smallcase platform at the selected frequency. The SIP amount gets transferred automatically from your bank account and invested in smallcase once the mandate is set.

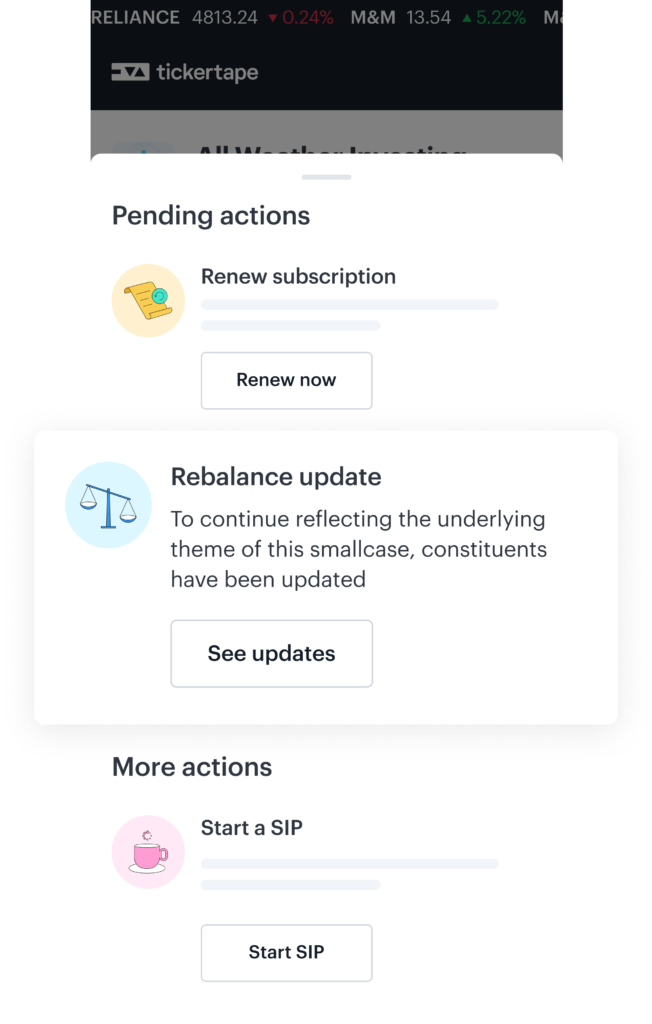

Rebalance

To ensure that a smallcase remains true to its theme or strategy, stocks/ETFs & their weights in a smallcase are reviewed regularly. This is known as rebalancing. Rebalancing is done by the Manager of the smallcase as per the defined schedule by taking into account various fundamental factors, company updates, etc. Rebalance updates are sent to investors via email by the smallcase manager as and when the changes become live. You can review and approve the rebalance update in 1 click by visiting the smallcase page on Tickertape.

How to track smallcase performance?

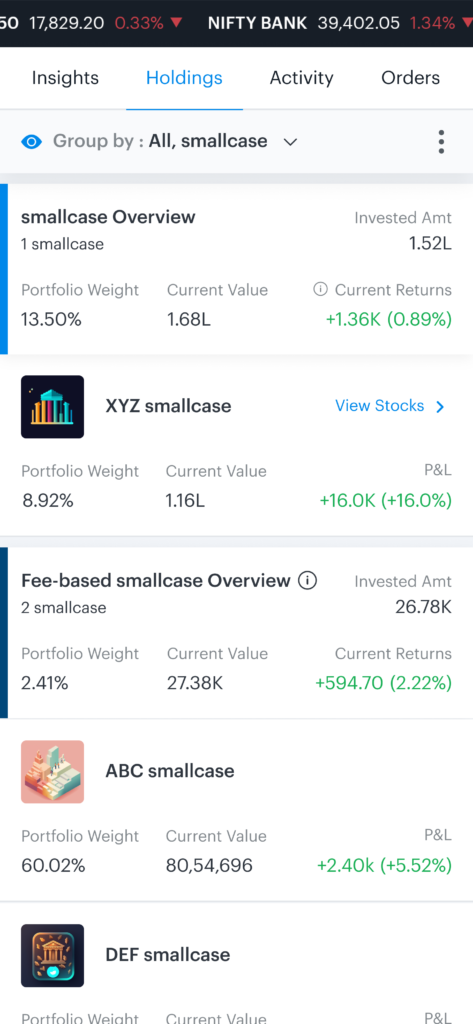

With smallcase, you don’t have to track the performance of your stocks individually. Simply track the performance of the entire smallcase by going to the Equity portfolio on Tickertape. Under the Holdings section, select Group by: “All smallcase”, and you can see your invested smallcases along with important information such as invested amount, current amount, the weight of smallcase in your equity portfolio and current returns. In addition to current returns, you can also check realised returns as well as dividends. You can go into further detail by checking the performance of individual stocks in your smallcase as well.

Whether you’re a seasoned investor or a beginner, smallcases on Tickertape offer stock baskets for every need and can help you create a well-diversified and customised investment portfolio. So what are you waiting for? Revolutionise your investment journey with us. Explore smallcases on Tickertape today!

Disclaimer: Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory.

The content here is for informational and educational purposes only. It should not be construed as professional financial advice nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.