Redflags 101: Protect Your Portfolio From Harmful Indicators On Tickertape

You find yourself on a rollercoaster, exhilarated as you soar through the air, held safely in place by a secure belt. Now, envision that rollercoaster as a representation of your investment portfolio, and that belt as the protective measure known as Redflags. This single component distinguishes between a secure journey and one fraught with uncertainty. It is imperative to provide your portfolio with a similar safety mechanism. This article aims to guide you on implementing Redflags within your portfolio, ensuring a secure journey towards your financial goals.

Let’s start with the most fundamental question,

Table of Contents

- What are Redflags?

- How do companies fall under these Redflags?

- Key indicators to determine the redflags in your Portfolio

- How to sync Portfolio?

What are Redflags?

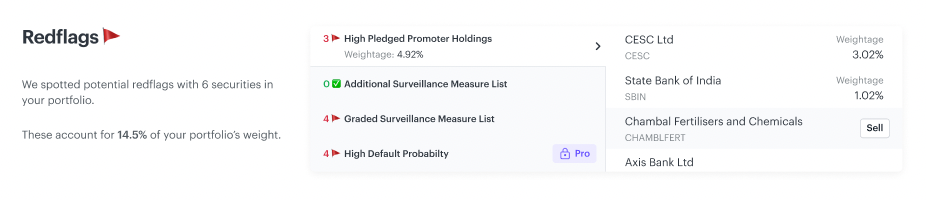

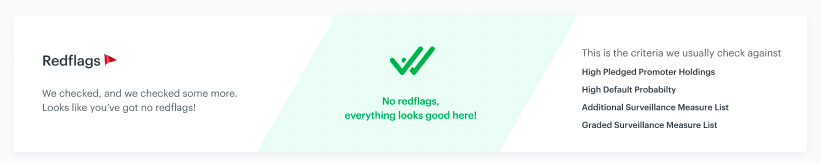

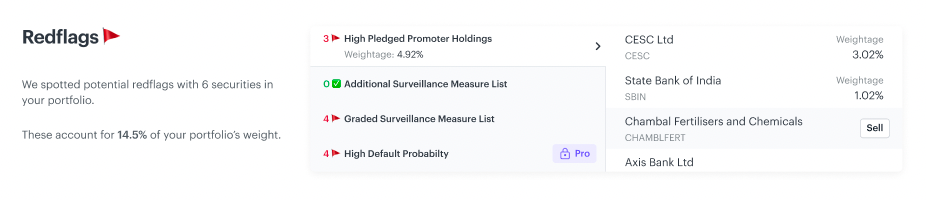

Redflags are not something to be afraid of. In reality, they are signals that draw attention to potential hazards linked to an asset in your portfolio, enabling you to detect potential problems before they escalate into significant issues. These indicators are identified using publicly available information from various sources such as SEBI and are categorised under multiple metrics. These warning signs could imply that the company’s performance is substandard, or it might have a higher debt level than usual. Regardless of the reason, Redflags serve as a cautionary sign that suggests it might be time to take corrective measures. By staying aware of Redflags, you can make judicious investment decisions and avoid unpleasant surprises.

But now you must be wondering;

How do companies fall under these Redflags?

There can be a variety of reasons why a company or organisation might fall under the watchful eyes of SEBI. Be it the case of poor management or a financial crisis, there are many reasons such as:

– Financial performance

A company’s financial performance is a key indicator of its health and potential for growth. Consistent losses, declining revenues or profits, and high levels of debt can all be warning signs that a company is struggling.

– High debt levels

High levels of debt can be a significant Redflag for investors. A company with a high debt-to-equity ratio may be overleveraged, meaning they have borrowed more money than they can repay. This can put the company at risk of defaulting on its debt and lead to financial instability.

– Poor management

If a company has a history of ethical issues, scandals, insider trading or even lack of diversity, it could be a major Redflag in this case and bring more harm than good.

– Unusually high returns

Any investment opportunity that promises unusually high returns is a major nope. While it’s natural to want to make a lot of money quickly, investments that seem too good to be true often are.

– Regulatory issues

Not following the legal route or being in line with the benchmarks set for standard could lead any company straight towards SEBI. Such non-co-operation is usually taken as a sign of potential danger and is flagged.

And that’s not all, despite these being some of the major reasons, there are in fact a variety of instances which could bring any company some unwanted attention, in a negative sense, of course.

Now that you have caught up on what are Redflags and what can make a company fall into them, aren’t you wondering, what’s next? What would happen to a company after they have been flagged by SEBI? And most important of all, what does that mean for your Portfolio?

Don’t worry. Let us tell you all about that, too, so you can make an informed decision anytime you want to add something to your precious Portfolio. If a company has been redflagged, it could lead to many outcomes, but all that depends on the severity, actions of the shareholders and many more factors. Here’s what could happen to a company:

- Increase in an investigation by SEBI

- Low investor confidence

- Changes in management

- Regulatory actions

- Or, Bankruptcy

Now for your Portfolio, adding redflagged stocks could be bad for your investment journey, not because of the stock itself, but the risks and potential problems it could bring you. When you add a redflagged stock, you might get lucky and get higher returns. Unfortunately, that’s just like winning a lottery (unlikely) so, in reality, your Portfolio could actually tumble down, face a major loss and be more volatile than general. All of this will not just impact your investing but can also take a toll on your confidence and market stability as well.

So much more could happen, but we don’t mean to scare you. If anything, we are here to help you out and summarise all of these redflags for you, so here, have a look at these key indicators that determine the redflags in your Portfolio and categorise companies in seconds so that you can avoid risk and enjoy safe returns always.

Key indicators to determine the redflags in your Portfolio

1. High-Pledged Promoter Holding

High pledged promoter holding is when a significant portion of a company’s promoter or major shareholder’s shares are pledged as collateral for a loan. This can happen when the promoter needs funds for business or personal reasons. However, high levels of pledged shares can indicate financial stress or risky business practices.

If a company falls into this criterion, it could signal instability and uncertainty regarding the company’s future prospects. This can lead to a rapid fall in the company’s stock price, which can have a negative impact on your portfolio.

2. High Default Probability

High default probability is when a company is at high risk of defaulting on its financial obligations, such as loans or bond payments. Companies can fall into this criterion due to various reasons, including high debt levels, declining revenues, or poor management decisions.

If a company has a high default probability, it could mean that its financial situation is doubtful, and there is a risk that it may not be able to meet its obligations in the future. This could lead to a downgrade in the company’s credit rating and a fall in its stock price. As a result, if you own shares in that company, it could negatively impact your portfolio.

3. Additional Surveillance Measure List (ASM)

The ASM list is a regulatory tool used to monitor stocks that exhibit unusual price movements, volatility, or other red flags. Companies can fall into this criterion due to various reasons, such as financial irregularities, corporate governance issues, or insider trading.

If a company falls into the ASM list, it means that it is under heightened regulatory scrutiny, and there may be some underlying issues that could impact the company’s performance. This could lead to a fall in the company’s stock price, and also cause a downside in your portfolio.

4. Graded Surveillance Measure List (GSM)

The GSM list is a similar tool used to identify companies that are at risk of potential price manipulation, insider trading, or other fraudulent activities. Companies can fall into this criterion because of irregular trading patterns, sudden spikes in volumes or prices, or other suspicious activities.

If a company falls into the GSM list, it means that it is under even closer regulatory scrutiny than companies on the ASM list. This could lead to a fall in the company’s stock price, which could cause a dent in your portfolio.

Avoiding the tedious process?

Monitoring red flags such as high pledged promoter holding, high default probability, and being on the ASM and GSM lists regularly can be a time-consuming and challenging task.

It requires a lot of research and analysis to identify companies that exhibit these red flags and assess their potential impact on your portfolio.

However, this process can be made easier by outsourcing it to us, where we collate all this data for you.

Our team monitors these red flags constantly and updates it for you in real time with the exact amount of red flags found in your potential investment.

With access to real-time information on a company’s financial metrics, regulatory filings, and other relevant data points, you can make informed decisions and mitigate potential losses.

How to sync Portfolio?

Syncing your Portfolio to Tickertape is now super easy and quick! Here’s how you can do it!

Step 1:

Tap the Portfolio button on the top right corner of the homepage.

Step 2:

Select the option to either create a new account with a broker of your choice or just sync an existing Portfolio

Step 3:

Log in to your broker account using your credentials

Step 4:

Grant Tickertape access to fetch your Portfolio holdings, and you’re all set.

Congratulations! Your Portfolio is now synced with Tickertape. Use our platform to monitor your investments, track your performance, and make informed decisions about your Portfolio.

Happy investing!