Mastering the Art of Future Analysis: Tickertape’s Pro Subscription for Stock Projections

It’s time to peer into the crystal ball and understand Forecasting, which has long captivated the minds of investors. So, how does Forecasting work?

- Understanding Historical Data: Tickertape’s Pro Subscription utilises past performance as the foundation for predicting the future. Like a skilled choreographer, it analyses price patterns, revenue trends, and earnings growth, transforming raw data into a forecast that sets the stage for investment decisions.

- Price Projections: Reveal the potential future price of a stock. This feature allows investors to peer into the crystal ball and gain insights into where a stock’s value might be headed. From soaring highs to grounded lows, the price projection becomes a compass guiding investors through the realm of the stock market.

- Revenue Forecasts: Understand the potential growth or decline of a company’s business prospects. Investors can embrace the thrill of uncovering whether a company’s revenue will flourish like a blooming garden or fade away like a vanishing spell.

- Earnings Forecast: This feature helps investors anticipate a company’s potential profits, granting them the power to make informed decisions. Whether the forecast unveils a pot of gold or a brewing storm, these insights allow investors to navigate the landscape of the stock market.

Table of Contents

- How to check the Forecasts?

- Analyst Rating Filters: Amplifying Market Sentiment and Building Investor Confidence

- Unveiling the Veil of Future Fortunes: Tickertape’s Forward-Looking Filters

- Watchlist to Forecast: Stay Updated With The Right Tools

- Already Invested But Intrigued By Forecast?

How to check the Forecasts?

For example; Taking the reference of HDFC stock, you can click on the Forecasts tab for the information.

Analyst Rating Filters: Amplifying Market Sentiment and Building Investor Confidence

Get a treasure-trove of insights through Analyst Rating filters. These filters act as an insightful window into the collective wisdom of market analysis, offering users a comprehensive overview of analyst recommendations. Prepare to be awed as we explore the various analyst features that amplify market sentiment and help build investor confidence.

Percentage of Buy Recommendations: It represents the chorus of analysts who, after careful analysis and research, recommend buying the stock. The higher the percentage of buy recommendations, the brighter the outlook and the stronger the vote of confidence in the stock’s future performance.

- Number of Analysts Endorsing the Stock: The number of analysts endorsing a stock reigns supreme. The more analysts gathered around a stock, the stronger its presence in the market’s collective consciousness. This multitude of perspectives grants credibility to their opinions and instills investor confidence, as the stock stands under the watchful gaze of a knowledgeable crowd.

- Percentage of Hold Recommendations: Amid the ebb and flow of market tides, the percentage of hold recommendations acts as a steadying force. It represents a neutral stance where analysts believe the stock’s performance will remain stable shortly. This balance of recommendations provides investors with a glimpse into the cautious currents of market sentiment, allowing them to navigate the uncertain waters with greater clarity.

- Percentage of Sell Recommendations: Beware the whispering winds of scepticism embodied by the percentage of sell recommendations. When analysts issue these foreboding recommendations, it signals a bearish sentiment and a pessimistic outlook on the stock’s future performance. A higher percentage of sell recommendations can serve as a warning sign, urging investors to investigate potential risks lurking beneath the surface.

- Total Number of Analysts Covering the Stock: The total number of analysts covering a stock symbolises its prominence. A larger group of analysts signifies a broader range of research and analysis, bestowing upon investors a wealth of expert opinions. With a multitude of voices to consider, investors can chart their course with confidence, fortified by a comprehensive understanding of market sentiment.

Harnessing the power of the Analyst Rating filters within Tickertape’s Pro Subscription, users unlock a deeper understanding of market sentiment and gain the ability to make more informed investment decisions. Whether basking in the warmth of buy recommendations, embracing the strength of a well-endorsed stock, recognizing the wisdom of hold recommendations, or heeding the cautionary sell signals, investors navigate the labyrinthine stock market with heightened insight and unwavering confidence. So, embark on this magical journey, where the Analyst Rating filters reveal the secrets whispered by market seers, guiding you toward the realms of investment success.

Unveiling the Veil of Future Fortunes: Tickertape’s Forward-Looking Filters

In the ever-changing landscape of stock investments, peering into the future performance of stocks has always been a quest for investors seeking a competitive edge. Fear not, Tickertape’s Pro Subscription offers a magical set of tools known as the Forward-Looking filters. These filters enable users to gaze into the crystal ball of stock projections, revealing glimpses of future growth. Join us as we delve into the mystical realms of Forward-looking analysis, where Revenue, EBITDA, EPS, and Operating cash flow take centre stage.

- 1Y Forward Revenue Growth: Like a blooming garden of financial abundance, 1Y Forward Revenue Growth provides a glimpse into the potential growth trajectory of a company’s top line. With this filter,r investors can estimate the expected growth in revenue over the coming year. Will the company’s sales soar to new heights or experience a gentle breeze of incremental growth? The answers lie within the filter.

- 1Y Forward EBITDA Growth: In the mystical realm of stock analysis, EBITDA reigns as a trusted measure of a company’s profitability. The 1Y Forward EBITDA Growth filter grants investors the power to envision the future profitability landscape. Will the company’s earnings before interest, taxes, depreciation, and amortization soar to majestic heights, heralding a period of robust profitability? Or will they follow a more modest path, steadily advancing toward sustainable growth? Unlocking this filter reveals the fortunes that lie ahead.

- 1Y Forward EPS Growth: As investors seek to understand a company’s potential for generating earnings per share (EPS), the 1Y Forward EPS Growth filter emerges as a guiding light. It offers insights into the expected growth in a company’s earnings per share over the next year. Will the company’s EPS paint a picture of prosperity, and project an upward trajectory? Or will it tread a more cautious path, signalling measured growth? This filter unveils the future of EPS, empowering investors with valuable foresight.

- 1Y Forward Operating Cash Flow Growth: Operating cash flow, the lifeblood of a company’s operations, holds great significance in the investment market. The 1Y Forward Operating Cash Flow Growth filter unveils the potential growth in a company’s cash flow over the next year. Will the company’s coffers overflow with abundance, paving the way for strategic investments and future opportunities? Or will it tread a more moderate path, indicating stable cash flow growth? This filter grants investors a glimpse into the financial vitality that awaits.

With Tickertape’sForward-Lookingg filters, investors can embark on a journey of discovery, peering into the future performance of stocks. By utilizing the 1Y Forward Revenue Growth, 1Y Forward EBITDA Growth, 1Y Forward EPS Growth, and 1Y Forward Operating Cash Flow Growth filters, they unlock a world of possibilities, where the path to profitability, earnings growth, and financial stability becomes clearer. So, embrace the power of forward-looking analysis and harness the power of these filters, as you navigate the realm of stock investments with wisdom and foresight.

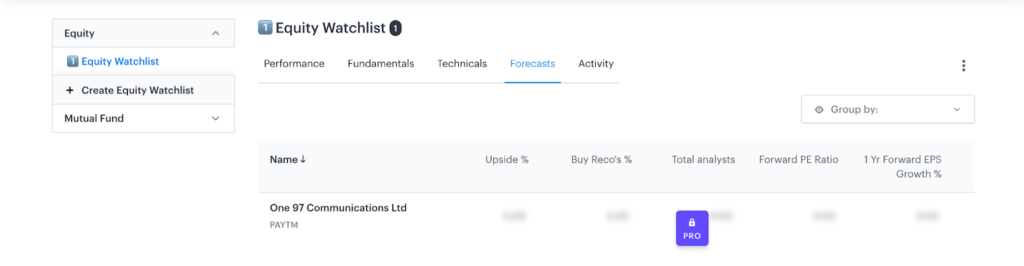

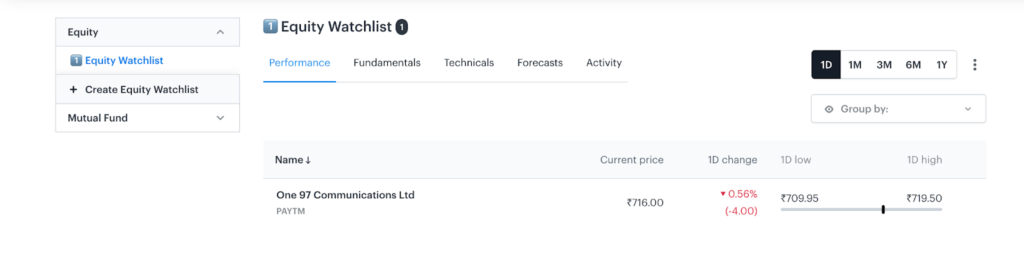

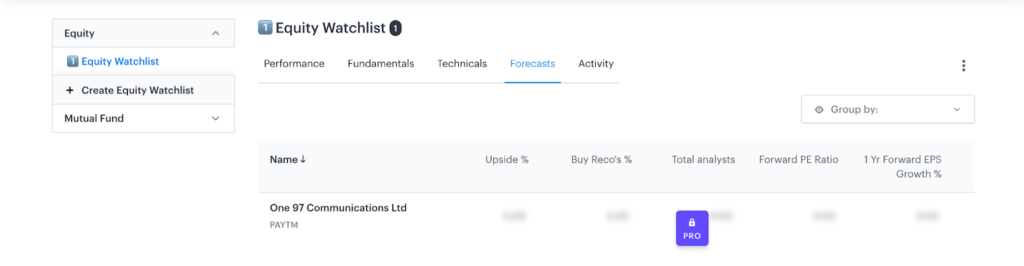

Watchlist to Forecast: Stay Updated With The Right Tools

You can also watchlist any particular stock, mutual fund, or investment via the Watchlist tab on the Tickertape platform. Let’s look at the steps:

Step 1: Click on the Account, and on the drop-down menu and click on Watchlist

Step 2: Create an Equity or Mutual Fund Watchlist, for example; we used PAYTM stock.

Step 3: Click on the Forecast tab to check/add/remove Forecast filters as mentioned above.

Already Invested But Intrigued By Forecast?

If you’ve already taken the leap into the world of investments, you can use Forecast on Portfolio. This tool allows you to unveil the future performance of your existing investments, providing a valuable layer of insight to guide your decision-making.

With Forecast on Portfolio, you can embark on a journey of proactive portfolio management.

You can also gain a deeper understanding of where your investments may be headed. With insights into future revenue growth, profitability, earnings per share, and operating cash flow, you can make informed decisions about rebalancing, adjusting positions, or capitalizing on emerging opportunities.